What legal structure is best for a home cleaning business?

Are you looking to start a cleaning business but unsure of what type of legal business structure is right for you? Choosing the right business entity is an important step in setting up your business, as it has major implications for taxes and liability.

In this article, we will discuss the different kinds of legal business structures available to entrepreneurs as well as help you choose which one is best for your cleaning business.

What is an LLC?

An LLC, or Limited Liability Company, is a type of business structure in the United States similar to a partnership or sole proprietorship, but with some added protections.

When you start an LLC, you create a separate legal entity for your business. This means that, unlike a sole proprietorship or partnership, your personal assets (such as your house, car, or savings) are protected from any debts or legal issues the business may face.

This protection is what makes LLCs a popular choice for small business owners. It gives you the flexibility of running your business like a sole proprietorship or partnership, but with the added benefit of not having to worry about your personal assets being at risk.

Another benefit of an LLC is that it’s relatively easy to set up and maintain. It typically involves filing some paperwork and paying a fee to the state government, but it’s not as complex as setting up a corporation. It also can give you a lot of flexibility in terms of management structure, you can manage it by yourself or with other partners, or even appoint managers.

In terms of taxes, LLCs are considered “pass-through” entities, which means that the profits and losses of the business “pass through” to the owners and are reported on their personal income tax returns.

Overall, an LLC is a good choice for small business owners who want some personal liability protection, but don’t want the complexity and formalities of a corporation.

Should I create an LLC for my cleaning business?

There are several reasons why a residential cleaning business owner in the United States might want to create an LLC:

- Personal Liability Protection: One of the main benefits of an LLC is that it provides personal liability protection for the owners, known as “members.” This means that the members’ personal assets are typically protected from any debts or liabilities incurred by the LLC. This can give the business owner peace of mind and protect their personal assets in case of a lawsuit or any other legal issues.

- Tax Advantages: LLCs are considered “pass-through” entities for tax purposes, which means that the profits and losses of the business “pass through” to the owners and are reported on their personal income tax returns. This can be beneficial for small business owners as it eliminates the need to file corporate taxes, and they can take advantage of certain tax deductions.

- Flexibility in management: LLCs offer a lot of flexibility in terms of management structure. They can be managed by the members themselves, or by appointed managers, depending on how the LLC is set up. This can be beneficial for a residential cleaning business owner who wants to be able to manage the business in a way that works best for them.

- Professionalism: Creating an LLC can give your business a more professional appearance, and it can be beneficial when it comes to doing business with other companies or individuals.

- Separation of Business and personal assets: LLCs create a legal separation between the business and the business owner’s personal assets, which can make it easier to manage the business and keep the business owner’s personal and business finances separate.

QUICK TIP FROM THE AUTHOR

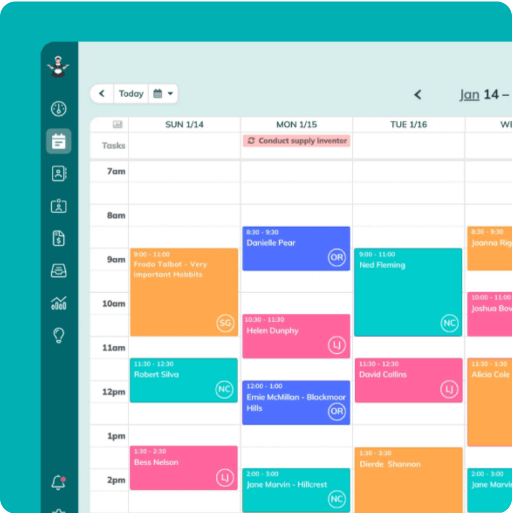

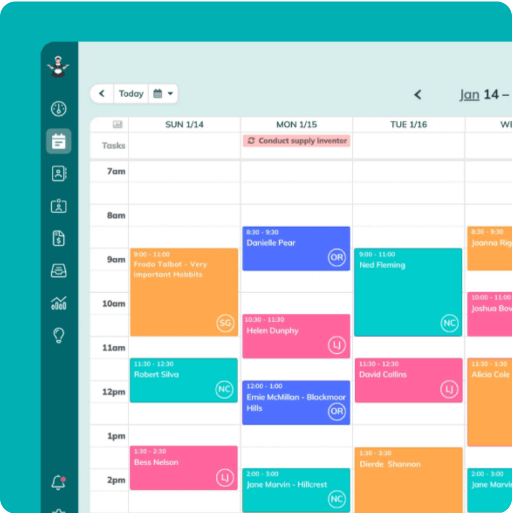

Simplify and enjoy your scheduling with a scheduling software made for maid services

- Have a beautiful calendar that's full but never stressful.

- Make your cleaners happy and provide all the information they need at their fingertips.

- Convert more website visitors into leads and get new cleanings in your inbox with high-converting booking forms.

- Become part of a community of 8000+ cheering maid service owners just like you.

Start your FREE ZenMaid trial today and discover the freedom and clarity that ZenMaid can bring to your maid service! Start your FREE trial today

What is a DBA?

A “Doing Business As” (DBA) is a name that a business can use to operate under, that is different from its legal name. It is also known as an “assumed name” or “fictitious name.” It is an official registration that a business owner files with the government, to legally operate under a different name than its legal name. This allows a business owner to have multiple names for their business, and use them interchangeably.

For example, if the legal name of a business is “John Smith Cleaning Service LLC” but the business owner wants to operate under the name “Sparkling Clean”, they can file for a DBA and do business as “Sparkling Clean” while still being legally known as “John Smith Cleaning Service LLC”

A DBA is relatively easy to obtain and is typically filed with the county or state government where the business is located. The process and requirements vary by state and sometimes by county, but it generally involves filling out an application and paying a fee.

Having a DBA can be useful for a business owner who wants to establish a separate identity or brand for their business, or for a business that operates under different names in different locations.

It’s important to note that a DBA doesn’t create a separate legal entity, it just allows the business to operate under a different name. It does not provide personal liability protection like an LLC does.

Should I register my cleaning company as a DBA?

There are several reasons why a residential cleaning business owner in the United States might want to create a DBA (Doing Business As) for their company:

- Branding: A DBA allows a business owner to operate under a different name than their legal name, which can be useful for creating a separate identity or brand for their business. For example, if the legal name of the business is “John Smith Cleaning Service LLC,” but the owner wants to establish a brand name like “Sparkling Clean”, they can file for a DBA and do business as “Sparkling Clean.”

- Advertising: A DBA can be useful for advertising purposes. It allows the business owner to use a catchy name that is easy to remember, which can help in attracting more customers.

- Expansion: A business owner can file for multiple DBAs, this can be useful if they want to expand their business and operate under different names in different locations.

- Confusion with similar names: Having a DBA can prevent confusion with similar names of other businesses, it can also prevent legal issues in case someone else is already using that name.

- Separation of Business and personal activities: A DBA can also be used to separate personal and business activities, it can be useful if the business owner wants to do different types of work under different names.

It’s important to note that a DBA doesn’t create a separate legal entity, it just allows the business to operate under a different name. It does not provide personal liability protection like an LLC does. The business owner still remains personally liable for the business’ debts and obligations.

What is a corporation?

A corporation is a type of business structure in the United States that is considered a separate legal entity from its owners. This means that the corporation can own assets, enter into contracts, and be held liable for its own debts and obligations, separate from its owners.

When someone starts a corporation, they are essentially creating a new legal entity that is separate from themselves. This new entity can enter into contracts, own assets, and be held liable for its own debts and obligations. The owners of the corporation are known as shareholders, they own shares of the company and they elect a board of directors to manage the corporation on their behalf.

Corporations are considered a more formal business structure, they have more complex and strict rules and regulations, and they are subject to more government oversight. They also have more formalities to follow, such as holding regular meetings and keeping proper records, and they are also subject to double taxation, meaning that the company pays taxes on its profits and then the shareholders pay taxes on the dividends they receive.

It’s important to note that corporations are not the best fit for all types of businesses, typically it’s more suitable for larger businesses or for those who are looking for more protection for their personal assets.

Should I create a corporation for my cleaning business?

Whether it’s a good idea for a small home cleaning business to create a corporation in the United States depends on the specific circumstances and goals of the business. Here are a few things to consider:

- Complexity and Formalities: Corporations are considered a more formal business structure with more complex and strict rules and regulations. They also have more formalities to follow, such as holding regular meetings and keeping proper records. This can be a disadvantage for small home cleaning businesses with limited resources and time to devote to these requirements.

- Double taxation: Corporations are subject to double taxation, meaning that the company pays taxes on its profits and then the shareholders pay taxes on the dividends they receive. This can be disadvantageous for small businesses with limited profits, as it can result in higher taxes.

- Personal Liability Protection: A corporation can provide personal liability protection for its shareholders by separating the business and personal assets, which can be beneficial for small business owners. However, LLCs also provide personal liability protection and are less complex than corporations.

- Growth and Investment: If a small home cleaning business is looking to grow and attract investors, a corporation may be a more appropriate business structure. However, if the business is looking to stay small, an LLC or a DBA may be more suitable.

It’s important to consult with a lawyer and accountant to understand the pros and cons of each business structure before making a decision, and also to understand if it’s the best choice for your business and your goals.

Ultimately, the legal business structure you choose for your cleaning business can have serious implications for your long-term success. Consider which type best suits your current and future needs, research all the requirements and regulations of the chosen structure, and finally consult a professional if necessary. With a well-thought-out plan and some effort, you’ll be sure to find a legal business structure that works best for you and your cleaning business!

Choosing the right legal business structure for your cleaning business is an important decision that should not be taken lightly. Depending on the scope of services you are offering and your goals as a business owner, selecting the right structure can provide significant advantages to your operations. We hope this article has provided you with a better understanding of the various legal business structures available, so you can make an informed decision for your cleaning business.

For more helpful articles on how to successfully start and grow a cleaning business, check these out:

- Why Your Cleaners Keep Going Over Time (And How to Fix It)

- How Kai DeMoss Went From a Gig App Cleaner to Real Clients in San Francisco

- How to Choose the Best Name for Your New Cleaning Business

- How Emily Built a $330K Cleaning Business After Starting Over From Zero

- Consult-Style Session on Scaling Fast While Staffing Smart, with Jennifer Dorn

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.