Why start a cleaning business in Ohio?

Are you thinking about starting a cleaning business in Ohio? Well, you’re in luck — Ohio’s diverse economy and competitive tax benefits make it a great location. The corporate tax rate is currently at 0.26%, which is lower than the national average. Ohio offers a variety of tax incentives to businesses, like the Job Creation Tax Credit and the Research and Development Investment Loan Fund. Add this with its low cost of living, Ohio could be the perfect location for financial success in the cleaning industry.

This article will provide all the essential information you need to know on how to start a home cleaning company in the state of Ohio, including necessary permits, training for staff, equipment needed, insurance requirements, and more. Let’s get started!

Table of contents

A quick note:

The contents of this article are meant to help you grow your cleaning business, but should not be taken as legal advice. Always consult with an attorney and/or accountant to help make legal and financial decisions. If you need help finding a professional in your area, see what other cleaning business owners recommend in our ZenMaid Mastermind.

Read this guide first: How to Start a Cleaning Business

For an overview and general guide, including a checklist, to starting a cleaning business, start here: How to Start a Cleaning Business in 10 Steps.

We suggest you read that first if you haven’t already, then return to this guide to continue with the specific requirements for Ohio.

QUICK TIP FROM THE AUTHOR

Simplify and enjoy your scheduling with a scheduling software made for maid services

- Have a beautiful calendar that's full but never stressful.

- Make your cleaners happy and provide all the information they need at their fingertips.

- Convert more website visitors into leads and get new cleanings in your inbox with high-converting booking forms.

- Become part of a community of 8000+ cheering maid service owners just like you.

Start your FREE ZenMaid trial today and discover the freedom and clarity that ZenMaid can bring to your maid service! Start your FREE trial today

Choose a Business Structure for your Cleaning Business

This is an important step that cannot be skipped. Go here for more information on the different legal structures and which one to choose for your cleaning business.

Do I need a cleaning license in Ohio?

In general, you do not need a specific license to clean houses in Ohio. However, depending on the particular services you offer and the city or county where you operate, you may need to obtain a business license, which is generally issued by the city or county where your business is located. To learn more about cleaning codes and cleaning certifications, save this post to read next.

Apply for an EIN (Employer Identification Number) for Ohio

You can apply for an Employer Identification Number (EIN) for your home cleaning business in the state of Ohio by following these steps:

- Determine if you need an EIN: An EIN is a unique nine-digit number assigned by the IRS to identify a business for tax purposes. You may need an EIN if you have employees or if your business is a partnership or corporation.

- Gather the necessary information: To apply for an EIN, you will need your legal business name and address, as well as the name and Social Security number of a principal officer.

- Apply online: The quickest and easiest way to apply for an EIN is online through the IRS’s website. You can fill out the online application form and receive your EIN immediately.

- Apply by mail or fax: You can also apply for an EIN by mail or fax by completing Form SS-4 and sending it to the IRS. This process can take several weeks.

- Apply by phone: You can also apply by phone by calling the IRS Business & Specialty Tax Line at 1-800-829-4933.

Please make sure you have all the documents ready and also check the state laws in Ohio as well for any additional requirements.

Here are the steps for an online application:

- Visit the IRS website at www.irs.gov/businesses and select the option to “Apply for an EIN online.”

- Complete the online application form, providing information about your business, such as the name and address of the business, the type of business entity, and the name and Social Security Number of the business owner.

- Submit the application.

- Once your application has been processed, the IRS will provide you with your EIN.

File/Register your business with Ohio

The state of Ohio requires that all businesses register with the Secretary of State.

The cost to register a cleaning business in Ohio varies depending on the type of business structure you choose. For example, registering an LLC can cost anywhere from $99 to $125, while registering a corporation can cost between $99 and $225.

If you are filing an LLC, you will file Articles of Organization. If you are filing as a Corporation, you will file Articles of Incorporation. For instructions visit and a list of costs to expect, please visit the state’s business portal here.

Business License Requirements in Ohio

Ohio requires a business license for general house cleaning businesses. But as things often change, check with the state’s licensing needs when registering a new business.

Be sure to also check with your individual county, city, or local municipality. Requirements can vary and some may need a general business tax, licensing, or other filing requirements for business.

Call your local municipality office and inquire if this is required.

Get Business Insurance

For a breakdown of why you need insurance, the different kinds of insurance to consider, plus the difference between insurance and bonding, read this guide first.

It is recommended to have business insurance when starting a cleaning business in Ohio. Business insurance can help protect your business and personal assets in the event of a lawsuit or other legal claim. Common types of business insurance to look into for cleaning businesses include general liability insurance, worker’s compensation insurance, and commercial property insurance.

Other Resources

Check these guides out next:

Ways to market your cleaning service for free

How to price your cleaning services

Free cancelation policy templates

5 automations to grow your cleaning business (that cost less than $100/month)

Still have questions or looking for advice from a fellow cleaning business owner? Ask your question in The ZenMaid Mastermind.

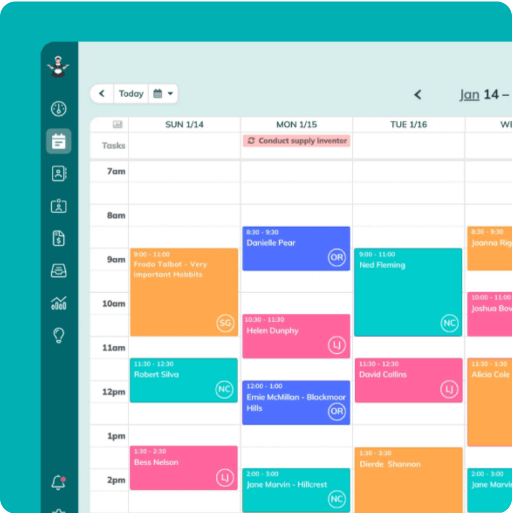

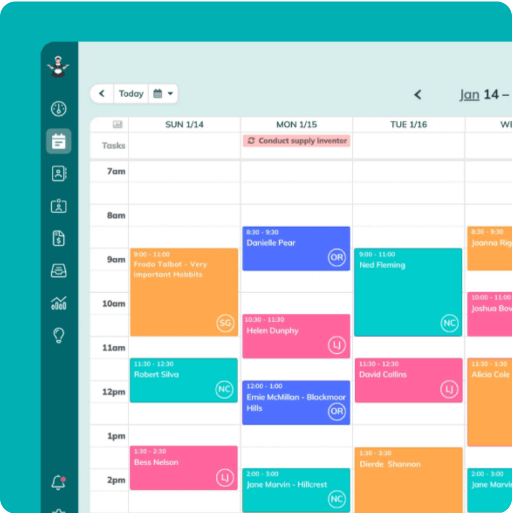

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.