The following article is based on a presentation given by Meaghan Likes at the 2021 Maid Summit, hosted and organized by ZenMaid.

Meaghan’s passion is educating and empowering other business owners across the world by teaching them how to find financial freedom in their own lives. She is known as a disrupter in the accounting industry, and her claim to fame is showing small business owners how to do their own bookkeeping correctly in less than 1 hour per month using Quickbooks Online — no accounting knowledge or experience required! Meaghan teaches smarter ways to make money, save money, and will inspire you to give back in meaningful ways.

As a business owner of several businesses, Meaghan’s systems work so well that she was able to transition to remote work (at full capacity) in less than four hours when Covid hit in March 2020. Her system was so efficient that she started educating others on it. In today’s article, we’re going to share her system secrets with you!

Declutter your maid service and feel empowered

Declutter. Empower. These two powerful concepts help small business owners live more financially rewarding lives.

With advanced technology at our fingertips, you can organize your business so that it’s completely paperless. When your work is virtual, it is possible to establish a stress-free system.

It’s time to get rid of the clutter and mess in your office so you can breathe a little bit easier — finally!

It has been a difficult few years. Everything seems complicated. We’ve had to make a lot of difficult decisions. Hopefully, you can look back and see all of the difficult things you’ve overcome.

Does decluttering and simplifying your maid service sound amazing? (It is!) Check out more resources on how to manage your business in one place — for FREE!

You may be craving a more organized life. People crave to be proactive again instead of reactive. If you want to be proactive, look no further. Follow this five file folder plan to declutter and empower your business.

#1 – The “To Do” File

First, go out and buy five blank folders that you can write on. They can be flashy or simple; whatever fits your style.

The “to do” file holds everything that you need to check off your to-do list — both personal and business-related. This file serves as a physical reminder for you.

Here are some examples of things on a to-do list:

- Vaccination cards: Make copies of your vaccination cards and digitize them so that you can access your copy from anywhere. If you want a more sturdy copy you can laminate your card.

- Travel Vouchers: If you’ve had a bit of bad luck with travel this year it is important to organize travel vouchers into your airline accounts.

- Auto Shop Notes: If you need some work done on your car these notes come in handy when it is time to fix a problem.

- Car insurance: These cards are a pain when you get a new one every six months or so. Nevertheless, it’s important to keep track of them.

- Gift cards: Activate and use!

- Car registrations: Need to pay these but haven’t gotten around to it? Keep them in this folder as a reminder.

- A baby or wedding announcement: You may need to respond to these in the next few weeks.

Pro tip: A great thing to buy for your file is blank envelopes. Keep these on hand for any last-minute mailing you need to do.

If you struggle to keep mail organized, use a designated mail bin for unopened mail. Once you open the mail, it either goes in a recycling bin or straight into your to-do file.

#2 – The “To Scan” File

Store your receipts and other paperwork in the “to scan” file. When the file starts to get thick, go through every piece of paper and scan each one.

If you get a piece of mail that is informative, nothing needs to be done with it, and you don’t have a digital record of it anywhere else, then it just goes in this to-scan folder.

The folder should only include about a month’s worth of papers. Don’t let it get too thick or you’ll want to kick yourself later! Stay on top of scanning to save yourself some stress.

#3 – The “To-Shred” File

Everything in here has been opened, dealt with, and scanned.

Pro tip: You don’t have to do step three yourself. Pay a niece or a young neighbor to shred your files for you.

Once you shred a piece of paper, it never has to go into a folder or a drawer again. You know that it is scanned, safe, and secure; out of sight, out of mind.

#4 – The “Taxes” File

Keep your tax documents as you receive them. You don’t have to be an accountant to keep your taxes organized and accessible.

In this folder you may have:

- A 1099

- Year-end tax statements

- Contribution letters

- Goodwill donations tags

If you have documents with any tax information, store them here!

Use a metal file rack to hold your folders. These racks keep everything neat and tidy. This is much better than the massive stacks of papers that you keep in your office.

#5 – The “Fire Box” File

If a fire broke out in your office, what items do you absolutely need to keep safe? Keep anything that is an important original copy in here.

A fire box, also known as a fireproof safe box, is a container used to store documents or small items of value. As the word indicates, these boxes are built to withstand a fire. Newer versions may even be waterproof.

Your fire box doesn’t have to be flashy or trendy, it just needs to serve its purpose.

Think about what would be difficult to replace and live without:

- Passports

- Titles to cars

- Immunization records

- Marriage certificates

- Death certificates

- Birth Certificates

- Life insurance documents

- Social security card

- Property titles and deeds

- Last will and testament

- Financial documents

- Important photos

Any original document that has a seal or a notary goes in this box.

Now that we covered the “five file folder system” we can move toward other questions about office organization!

How long should you keep things?

As a business owner, you should keep your documentation for your tax returns, receipts, invoices, and anything that you took as a deduction for seven years. Some accountants think that three years is sufficient time. But to stay on the safe side, keep your documents for seven years.

To some people, seven years is a long time. Yet if you keep things organized and neat, it won’t seem cluttered. No one wants to be a hoarder, but you do want to legally protect yourself with the important information from your documents.

Always keep tax returns, titles, deeds, corporate documents, and estate planning documents. Save documents for property that you don’t own anymore to prove that you don’t own it in the event of a lien.

Yes, keep your tax returns — forever! Now that we live in an age where we can digitize everything and keep a copy on a flash drive, it is feasible to keep your tax returns into old age.

Keep your flash drives in a secure place. Make a physical copy and a copy online. Google Drive offers secure and easy to access storage.

What should you do with your receipts?

Have you ever had stacks of paper that seem like the leaning tower of Pisa? Everywhere you look you see paper. It can be overwhelming. Receipts are the same, just a little bit smaller but no less troublesome.

As a business owner, you need to keep track of them. This feels like a hassle because receipts are pesky things.

Designate a receipt jar. Stuff every receipt in here. It’s helpful to write a note on each one with a small description. If you ate lunch with a potential client, write who you were with and why.

When your jar is full, straighten each receipt and take a picture of it. If you use Quickbooks Online, you have the option to upload these pictures. Quickbooks automatically attaches the photo to your credit card transaction.

If you are audited, you can extract this data from Quickbooks.

After everything is uploaded and saved, go ahead and toss your receipts in the trash.

Looking for more accounting tips? Check out this article to read our 3 rules for exploding your profits.

Use Google Drive

Create a folder for every year on Google Drive. Next, create a folder within every year for each vendor in your business.

One amazing perk of Google Drive is that you can copy each folder over from year to year.

Scan a document, save it by the date on the document and the name of the vendor, and then place it into the appropriate vendor folder.

If you have multiple work vehicles, you can create a folder for each vehicle. Create folders that make sense to you.

It’s important to simplify your system in a way that works with your brain — not just someone else’s, even if they are the “expert.” If it doesn’t make sense in your brain, your system won’t work for very long.

Google Drive is really easy to use, so take advantage of it when you organize!

Again, include:

- Name of the vendor

- Date of the invoice

- Another identifier or description

Your next steps

If you ever find yourself frustrated with a messy office space, take the time to implement these organizational takeaways from Meaghan Likes.

An organized system saves you time, hassle, and stress in both your personal and business life. Declutter and empower your business today!

If you found this article helpful for your maid service, you may also like:

- Square-Foot Cleaning Rates Are Failing You. Here’s a Better Pricing Method.

- Sidi Thiam on Sales Skills and Pricing Confidence

- How Victor’s Residential-First Model Achieved 600+ 5-Star Reviews

- Cleaning Business Insurance and Bonding — Types, Cost, Requirements & Top Providers in 2026

- The Official 2025 Naughty and Nice List

For more resources on how to grow and perfect your cleaning business, check out the replays from the 2021 Maid Summit, hosted by ZenMaid. The summit featured more than 60 presentations from other maid service owners who shared tools and strategies to help you achieve the highest levels of success in your business.

To hear Meaghan Likes’ full talk from the Maid Summit, click here.

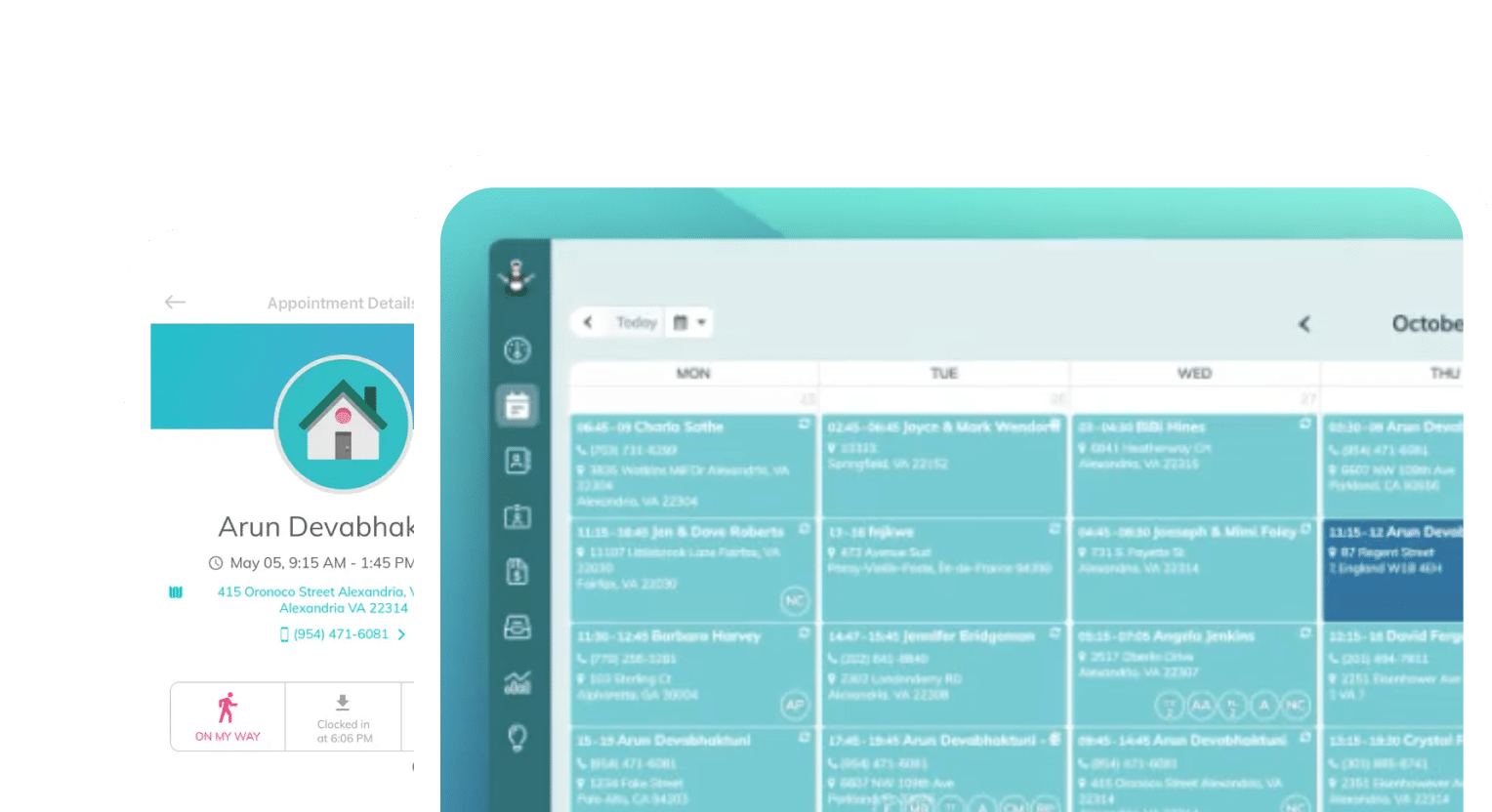

Try ZenMaid for free!

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.