Unless you’re an accountant or love numbers, managing your books can be one of the least enjoyable parts of running your business.

Even though it’s a necessary part of being a business owner, not every entrepreneur knows how (or even why) they should keep an eye on their books.

Bookkeeping is how you record financial transactions so that you can keep track of things like your income, expenses, and how profitable your business is.

Maintaining accurate records of all of this information can tell you how much money you’re spending on your business and help you understand how much you’re making.

If you’ve just started your maid service and don’t have the budget to hire a bookkeeper, then you might be managing the books yourself while you work on growing the business.

Whether you’ve hired a bookkeeper to manage the numbers for your cleaning business or are still doing it yourself, you need to have the right financial systems in place. The right systems and processes will make sure your numbers stay organized and you don’t run into any hidden surprises come tax time.

In this post, we’ll show you three strategies to implement into your bookkeeping process that will save you time and let you manage your books in under one hour per month.

Use the right financial tools

One way to better understand your numbers as a business owner, is to use tools designed to help simplify the bookkeeping process.

According to Meaghan, one of the most impactful things a small business can do to streamline their books is to start using Quickbooks Online.

In the past, Quickbooks Online had a reputation of being slow, clunky, and not as robust as the desktop version of the tool. Fast forward to today, and the online tool offers everything from the desktop version and even more.

The main selling point, and the feature that will save you the most time, is its intuitive AI software.

You can connect Quickbooks Online with your bank so that it securely syncs all of your business transactions within the software. As you create transactions and make money, the tool will begin to learn rules about your finances and automatically categorize your transactions, expenses, and income.

This makes reconciling your accounts so much easier. It also requires much less manual labor in managing your books.

Using the right bookkeeping tools can also make you feel more confident in your business because it leaves less room for you to second guess whether or not you’re doing it right. Tools like Quickbooks are designed for business owners, not financial experts, and are there to help you manage your finances in less time.

Make your business paperless

As businesses become more digital, you can keep your finances more organized by making your business as paperless as possible. Keeping track of paper receipts, paystubs, or documents can add another layer of stress to your bookkeeping process.

To make your business more paperless, start by creating three files that you use to store any new papers or documents that you find or receive. Label these files as: to-do, to scan, and to shred.

To-do

If you receive mail or a document with an action item, put it in the to-do file. Set aside time every few weeks to tackle everything in that folder.

To-scan

Any time you finish an item from the to-do folder, add that document to the scan folder. In this folder, you can also store receipts or documents you receive that you need to keep.

Once a month, go through everything in this folder and scan it to save a digital copy. While you’re scanning everything, try to identify if you can opt-out of receiving these paper documents in the future.

For things like bills or bank statements, you can usually ask for your account to be completely paperless so that you stop receiving physical mail and only receive those items via email.

If you’re using Quickbooks, it’s extremely easy to scan and store receipts in your Quickbooks online account. You can take a photo of the receipt with your phone and import it. Then, the software will automatically recognize the name of the vendor and dollar amount, and it will attach the receipt to the transaction online. When you add a photo of a receipt, the software will also automatically create a transaction in your account and accurately categorize the transaction for you.

To-shred

After you’ve digitized everything in the to-scan folder, you can begin to shred and recycle those documents.

Suppose there are documents that you absolutely need to keep a physical copy of. In that case, you can save a small firebox or file cabinet that stores the physical copies of important documents.

A few other ways to make your finances more paperless can include:

- Switching to a fully electronic payroll

- Signing up for “Do Not Mail” lists to reduce junk mail

- Asking your vendors to only send digital receipts or order forms

Simplify your tax documentation

A large part of tracking your finances is to make your life easier come tax season. If you have a CPA do your taxes for you, it’s still important to understand what they did with the information you provided to find ways to streamline the information you gather.

For example, you might think it’s necessary to add every single source of income into a specific category to file your tax return correctly. But there is only one line for gross business income on your tax return.

Categorizing your expenses and revenue helps you understand your business’s financial health but is not always necessary when it comes to filing your taxes.

If you’re using a CPA, ask them to share how they have been categorizing your transactions for tax purposes.

Knowing what categories they use can save you time and money because you can start using more simplified categorizations. This will save you time when you’re gathering the information and allow them to spend fewer hours on your taxes.

Final Thoughts

From managing payroll to growing your profits, the right bookkeeping process can save you time and money and keep your business running smoothly. Whether you hire a professional or choose to manage your books yourself, you don’t have to spend countless hours staring at your numbers.

You don’t have to be a financial expert to run a small business. But it is important to have a basic understanding of your finances. It might seem overwhelming at first, but once you have the right systems implemented, you can start managing your books in less time.

About the presenter

Meaghan Likes is a CPA and founder of the Bookkeeping Academy Online. Her passion is for educating and empowering other business owners worldwide to find financial freedom in their own lives. She teaches smarter ways to make money, save money, and inspire you to give back in meaningful ways. In this post, we’ll share Meaghan’s tips for how to manage your maid services books in less than one hour per month.

This talk first aired at the 2020 Maid Service Success Summit.

The Maid Summit is an annual online event that brings together the most successful leaders in the cleaning industry, like Debbie Sardone, Angela Brown, Courtney Wisely, Amy Caris, Chris Schwab and more. Get free access to masterclasses and workshops that will help you to grow, scale and automate your cleaning business so you can get more leads and create more profit. Make sure you’re on our email list to find out how to get free tickets to the next event.

Discover more helpful articles to grow and automate our Maid Service:

- Filthy Rich Cleaners Podcast E28: How Much Does a 7-Figure Business Owner Take Home? + More Juicy Q&A’s

- Filthy Rich Cleaners Podcast E27: The Lead-Converting Marketing Secrets Most Cleaning Businesses Get Wrong

- Filthy Rich Cleaners Podcast E26: The Client Retention Strategy Your Competitors Don’t Want You to Know

- How to Set Up Your Cleaning Booking Forms with ZenMaid: The Complete Guide

- Filthy Rich Cleaners Podcast E25: How Kate Croukamp Built a 7-Figure Product Line in Her Cleaning Business

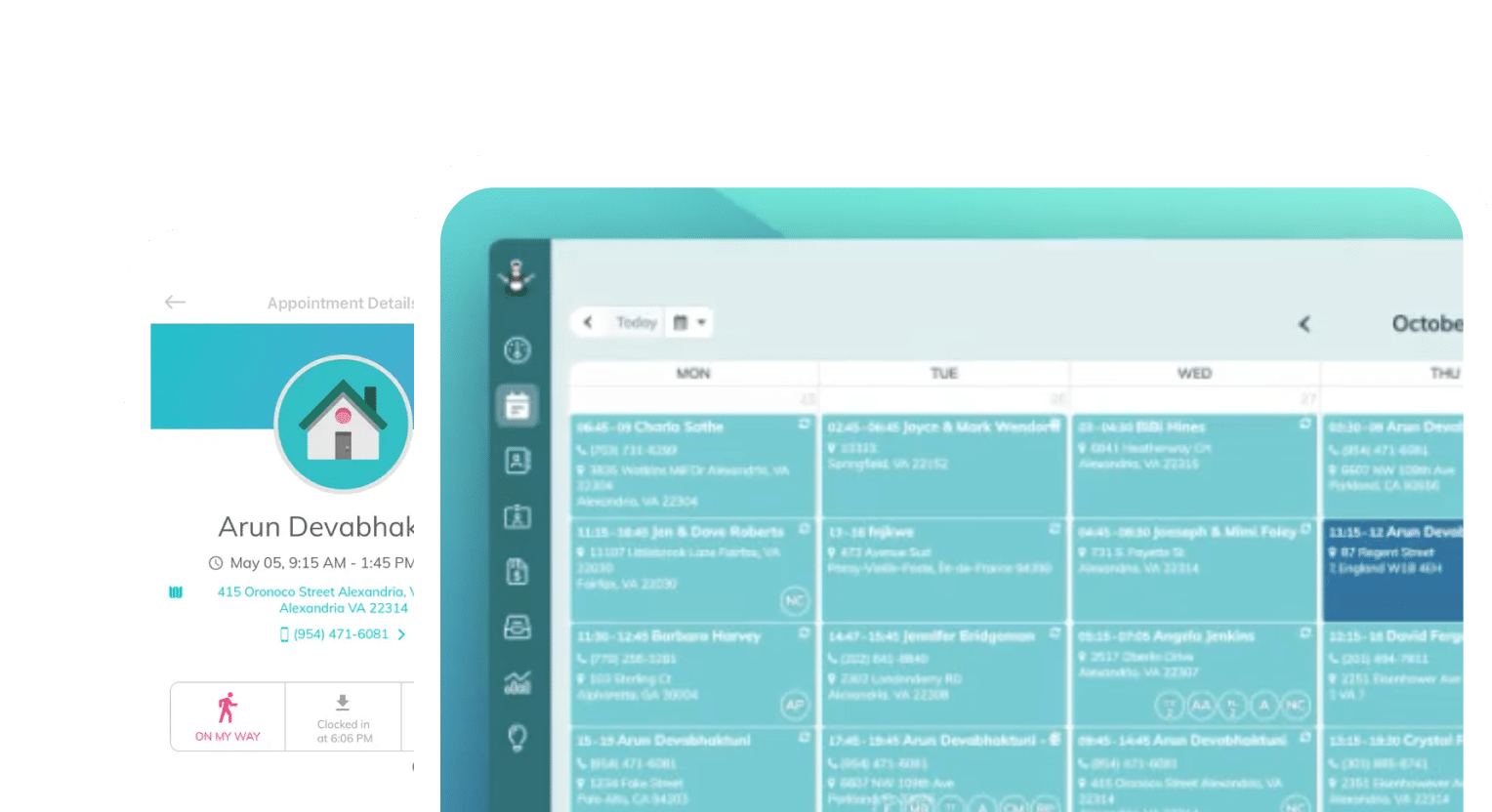

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.