Every entrepreneur has an idea of how they want to run their business. Early on in the entrepreneurship journey, you learn what kind of marketing systems you want to implement, what kind of people you want to hire and what you want your business to afford you.

One area that often goes ignored until it’s too late, are the financial systems that keep your business afloat.

When you’re first building your business, it’s easy to put off managing finances as a low priority. If you don’t have a background in finance, you might assume that you’ll be in over your head when it comes to setting up financial systems.

It might make more sense at the time to focus on marketing or sales or to reach a certain income goal before you prioritize your financials. But if you don’t know what’s happening in your bank account, then you can’t know what is happening in your business.

It can be scary at first. Getting to know the financial health of your business might reveal some nasty truths that you don’t want to face. But without confronting the numbers, you put your business at risk of hemorrhaging money and never becoming profitable.

Let’s talk about six easy and actionable steps you can take to set up better financial systems within your maid service.

Separate your personal and business expenses

It’s important not to commingle your funds. As a business owner, you need to have a separate bank account for your business that you don’t use for personal spending.

Separating your personal and business expenses will help you get a clearer picture of your finances. It will also make it easier to track your spending, and understand your numbers come tax time.

Whether you’re handling your finances yourself or working with a professional, keeping these accounts separate will reduce any confusion around how much your business is spending.

Having separate accounts is also key when it comes to managing cash flow. You’ll have a more accurate idea of how your business expenses compare to your revenue.

Categorize transactions line by line

Set aside time on a weekly or monthly basis to go through your bank statements line by line and categorize all of the transactions. This will become so much easier when your account is exclusively for business spending as you won’t have to sift through personal transactions.

For each item you spend money on, give it a label. These labels can include things like marketing activities, office supplies, staff costs, software costs, and more. The goal is to understand where every single dollar you are spending is going.

You’ll be able to have a birds-eye view of how much you spend on each category of your business, and where you might need to reduce costs.

Then, review this data weekly to keep track of what areas of your business you’re spending the most money on.

Calculate your profit on a weekly basis

Working with a bookkeeper can save you a lot of time from handling your finances yourself. However, Denai recommends that you still calculate your own profits on a weekly basis until you are comfortable enough with your own numbers.

A lot of times, when working with a bookkeeper, you’re getting lag reports. Your bookkeeper will likely send you a report around once a month. So you end up seeing your numbers after the fact and aren’t able to make adjustments to your budget or spending until it’s too late.

Depending on what stage your business is in, this might not be an issue. However, if it’s early days and you are trying to be as lean and profitable as possible, adjusting your budget once a month might not be enough.

Calculating your numbers every week ensures that every decision you make is based on your most up to date financial data.

Focus on the things that make the most of your money

Numbers don’t lie. Make sure you’re focusing most of your energy on the aspects of your business that make the most money.

This includes tracking how well each of your marketing channels is doing. Calculate how much you are spending in marketing dollars and which channels create the most profits. It can be tempting to want to tackle as many marketing channels as possible.

Making new marketing channels profitable can take time. So unless you are willing to lose money up front through testing and experimentation, stick to the channels that you’ve proven work well for your business.

Focusing on the things that make you money also means not fixating on things that don’t matter, such as overall revenue. When tracking your numbers, profit is the most important number to watch.

Without profits, your business won’t be sustainable for long because it’ won’t be able to sustain your lifestyle.

Think like a CFO

If you’re not in a place where you can hire someone to manage all of the finances of the business, it’s important for you, as the owner to own the role.

Acting as your own Chief Financial Officer forces you to prioritize handing your finances on a regular basis. It will also help you prioritize creating financial systems that make sure you’re building a business to support the life you desire.

When thinking like a CFO, it’s important to be as organized as possible. Create and document systems around your financial processes. Creating these systems early on will also make it easier to hire someone else to step in and take over the financial planning aspects of the business.

Determine your financial goals

When you’re running a business, your job is to make money. The only way to make money in a sustainable way is to understand your numbers. You need to know how much money is coming in and out of the business to make sure your business stays in a financially healthy position.

Ask yourself whether or not your current business will support the lifestyle that you want. When you started your business, it’s likely that you had a financial goal in mind.

If not, it’s important to really think about how much profit your business needs to make to support your lifestyle and allow the business to continue growing.

You can start figuring out this number by calculating how much you want to pay yourself as your annual salary. Then, by looking at your current revenue and expenses, you should be able to determine if this is a realistic amount. If it’s not feasible at the moment, then you need to find ways to increase your profits so that you can meet those income goals.

Final Thoughts

Think deeply about why you started your business. Whatever that reason, the success of that goal comes down to making enough money to achieve it. Whether you want to help more people, impact your community, or feel more financially secure for your family, the more money you make, the easier it will be to fulfill that “why”.

You put time and energy into things you think are important and somewhere along the way, managing finances became less of a priority. It’s time for that to change.

To learn more about how to manage your finances as a maid service owner, or how to hire someone who can, check out Denai’s complete presentation from the 2020 Maid Summit.

About the presenter

Denai Wolfe is a Virtual CFO, founder of The Chic CFO and host of The Profit Factor podcast, and is dedicated to helping entrepreneurs increase their profits and decrease their stress. She works with business owners to empower their understanding of their finances and help them make financial improvements within their company.

This talk first aired at the 2020 Maid Service Success Summit.

The Maid Summit is an annual online event that brings together the most successful leaders in the cleaning industry, like Debbie Sardone, Angela Brown, Courtney Wisely, Amy Caris, Chris Schwab and more. Get free access to masterclasses and workshops that will help you to grow, scale and automate your cleaning business so you can get more leads and create more profit. Make sure you’re on our email list to find out how to get free tickets to the next event.

If you found this article helpful, check out these ones, also on ZenMaid Magazine:

- How to Set Up Your Cleaning Booking Forms with ZenMaid: The Complete Guide

- Filthy Rich Cleaners Podcast E25: How Kate Croukamp Built a 7-Figure Product Line in Her Cleaning Business

- How to Transition from Paper Scheduling to Software in Your Cleaning Business (Without Losing Clients or Your Mind)

- Filthy Rich Cleaners Podcast E24: Why I’m Cutting a $56k Service from My Cleaning Business

- 5 Hidden Costs of ‘Free’ Scheduling: What 4 Cleaning Business Owners Wish They’d Known Sooner

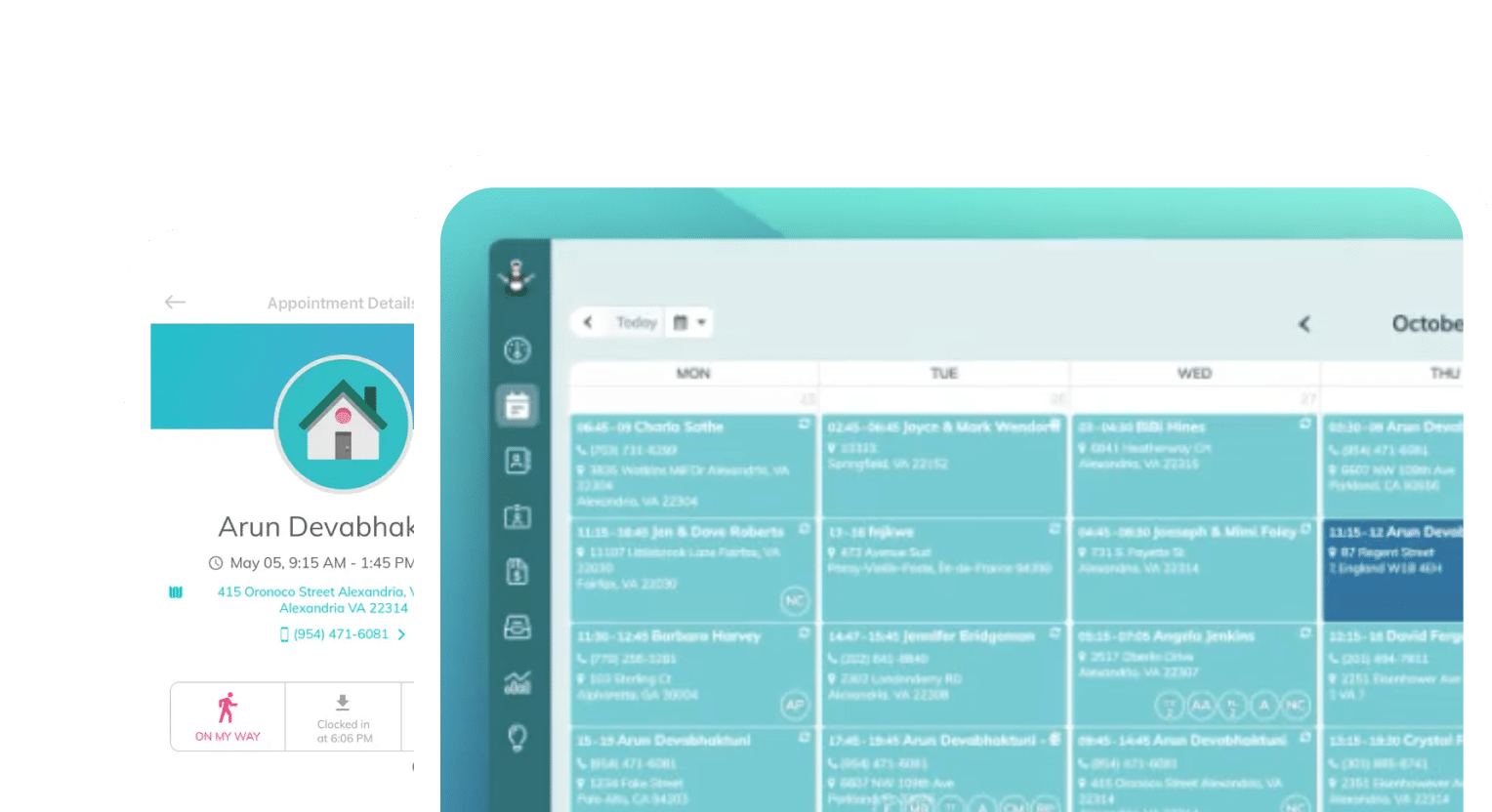

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.