WHY TRUST US? The ZenMaid team has eight current and past cleaning business owners, including our CEO and founder Amar, who know the ins and outs of the maid service industry like the back of their hands. They share their expertise with us in product development, with the customer success team, and content, which includes the article you’re about to read. We also partner with some amazing leaders in the cleaning industry, like Debbie Sardone, Angela Brown, Courtney Wisely, Chris Schwab, and more, to provide you with the latest industry insights. The tips and advice you’ll find on our blog have helped our team grow their maid services, and we’re excited to share them with you to help you grow your business too.

KPIs for a profitable cleaning business

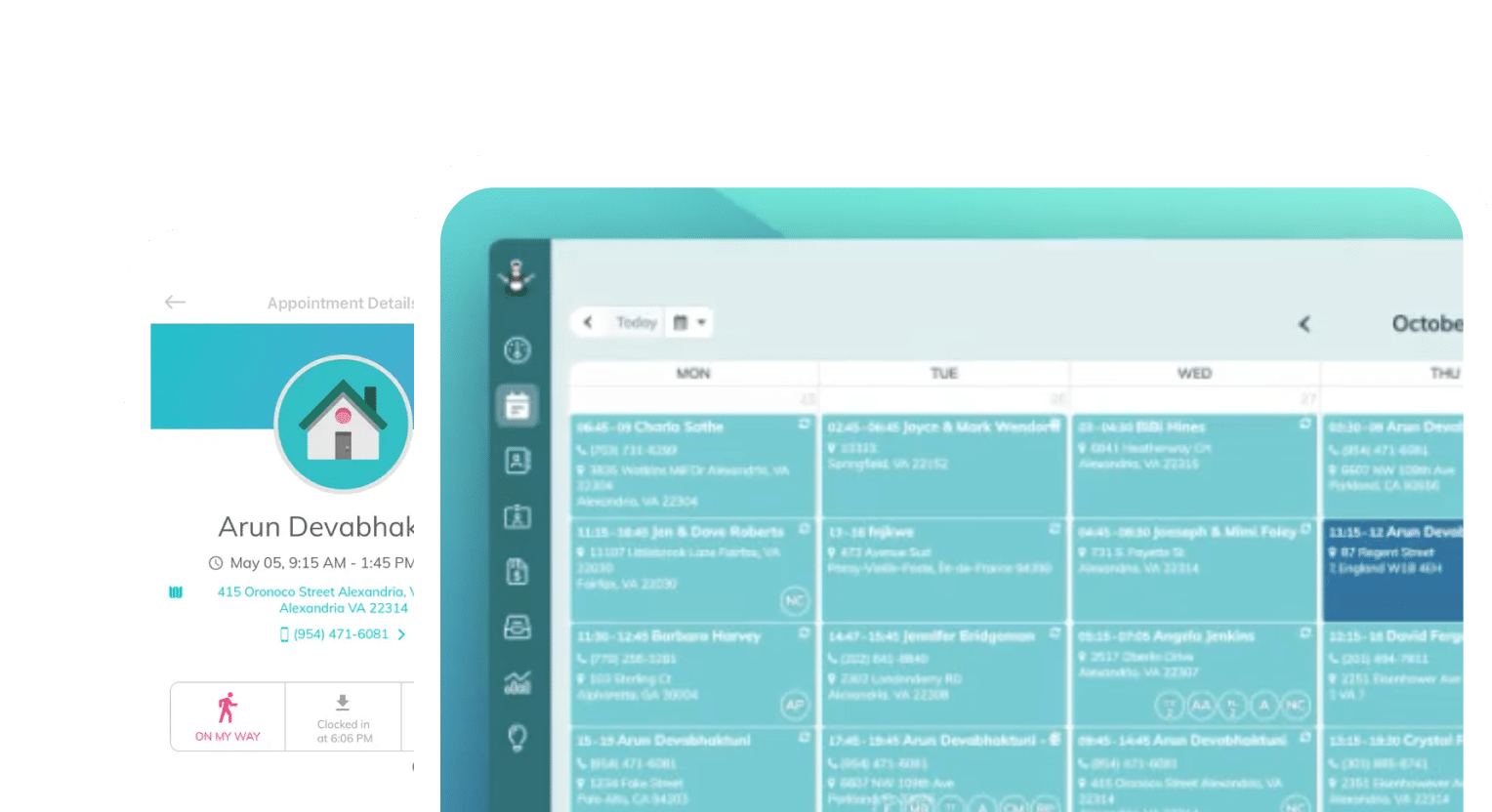

ZenMaid is the simple scheduling software that will help you save 30+ hours in your cleaning business every week. Join thousands of other cleaning business owners who now have time to take a nap, spend time with their family and take vacations! Start your free 14-day trial today to discover how many hours you can get back in your week.

Estimating costs and tracking key performance indicators (KPIs) are what can set you apart from cleaning businesses that remain stagnant and cleaning businesses that grow into six-figure revenues. In this article, we’re sharing Mike Callahan’s top tips for mastering your KPIs.

But first, let’s cover the steps of setting up an effective estimating system and using key KPIs to ensure you’re hitting your hourly goals per cleaner. Setting this system up lays the foundation to master your KPIs.

Table of contents

Estimating an average wage calculation

To establish a solid foundation, start by calculating the average wage of your cleaners. This principle can be adapted for independent contractors or employees. We can determine the total payroll liability by putting the number of employees (or contractors) and their hourly wages. Considering factors like the number of weeks worked, hours per day, and days per week, you’ll arrive at an estimated figure.

Understanding labor costs and burdens

When it comes to estimating costs and determining key performance indicators (KPIs) for profitability, one crucial aspect to consider is labor expenses. By analyzing the numbers and implementing an estimating system, you can gain valuable insights into the financial health of your cleaning business.

Calculating average wage and labor burden

To start, you’ll need to calculate the average wage of your employees. While the specifics may vary depending on factors like employment type (employees vs independent contractors), the concept remains the same. Utilizing a spreadsheet or dedicated software, input the hourly wages for your cleaners. Consider different positions, like cleaning technicians and crew leaders, each with their respective hourly rates.

Next, factor in labor burdens such as company share FICA, federal employment, state unemployment, liability, vacation pay, holiday pay, health insurance, and company bonus fund. These burdens are typically shown as a percentage of the payroll. For instance, if your labor burden is 19% of the payroll, every dollar spent on wages equates to around 19 cents in additional costs.

Determining true labor costs

Calculate the labor burden-adjusted hourly rates to accurately determine the true cost of labor. Whether you use industry-specific software or a Google sheet, ensure that your tracking system allows you to input both the hourly rate and the labor burden percentage. This way, you can obtain an accurate figure for the actual cost of each hour worked by your cleaners. For example, a cleaner earning $16 per hour may actually cost $19.04 when accounting for the labor burden. Likewise, a cleaner earning $22 per hour may translate to a total cost of $26.18.

Build a comprehensive budget

Once you clearly understand your labor costs, it’s time to create a comprehensive budget that incorporates various elements of your cleaning business.

Allocating payroll expenses

Start by determining the payroll expenses specific to each division of your cleaning business. If you operate both residential and commercial cleaning services, it’s advisable to separate these divisions in your budget calculations. Consider the number of employees in each division and their respective hourly rates. You can estimate the total payroll liability by multiplying the hours worked per week by the number of weeks in a year. For example, if ten cleaners work an average of 40 hours per week for 51 weeks, the total payroll liability would amount to 20,400 hours.

Evaluating vehicle costs

Consider the vehicle expenses associated with your cleaning business. If employees use their own vehicles, you’ll need to account for mileage reimbursement based on the average market rate. Alternatively, if you provide dedicated vehicles for your cleaners, assess the costs related to vehicle purchase, financing, depreciation, and salvage value. Remember to include both driving and curb time in your calculations to accurately reflect the overhead incurred by using these vehicles.

Adapting and fine-tuning your budget

Keep in mind that while this article provides a comprehensive budgeting framework, your business’s specifics will vary. Adapt this framework to fit your unique business, and always work with a professional financial professional when making decisions for your business.

That said, consider the following components to create a profit and loss statement:

Gross sales, materials, and labor

Calculate the total gross sales for the year, including any taxes. Determine the cost of materials, which encompasses cleaning supplies, equipment, and any other direct expenses. For labor costs, refer to the average wage calculations previously done. Multiply the total scheduled hours by the average wage and include the 19% labor burden. If you utilize subcontractors or rental equipment, allocate the respective costs under those categories. The sum of these figures will give you the total cost of sales and gross profit.

Overhead expenses

Combine the expenses detailed earlier with estimations for advertising, depreciation, insurance, downtime, office supplies, salaries, taxes, utilities, and others. Express these expenses as a percentage of gross sales. Additionally, factor in any charitable donations, education costs, uniform expenses, computer and software systems, bad debt, and retirement plans. Incorporate these costs into the overhead section of your profit and loss statement.

Net profit and profit margin

With all the expenses accounted for, subtract the total expenses from the gross profit to calculate the net profit or loss. Express the net profit as both a monetary value and a percentage of gross sales. This provides a clear picture of the business’s profitability and allows for easy comparison with industry benchmarks.

Once you’ve completed the profit and loss statement, we recommend setting up a budget in accounting software such as QuickBooks Online or QuickBooks Desktop. By doing so, you can track your actual performance against the budget on an accrual basis. Regularly reviewing and comparing the budgeted numbers with the actual figures will enable you to make course corrections and maintain financial stability throughout the year.

Remember, this budgeting and pricing process requires attention to detail and regular evaluation. By implementing these strategies, you can gain clarity, accountability, and financial control over your cleaning business, ultimately leading to long-term success.

Handling variables in your estimates

In addition to the square footage of a home or commercial space, there are other variables to consider when estimating the cost of cleaning services. One is the number of pets in the home. While the client may not see this information, you can use it behind the scenes to customize your estimate. For example, you can include up to two pets without any additional charge, but for each pet over two, you may want to charge an extra $20 or $15 per cleaning. Adjust these numbers based on your market and preferences. This approach can be extended to include other variables, like linen changes or specific client requirements, allowing you to offer customized and accurate estimates.

Price break model

The price break model involves setting different prices based on specific square footage ranges or other factors. For instance, in the case of a weekly cleaning service, you can establish different prices based on the home’s square footage. For homes between 1 and 1,200 square feet, the price could be $115.24. For homes between 1,201 and 2,200 square feet, the price might be $175, and so on. By determining the budgeted time for each range and multiplying it by your hourly rate, you can establish fair prices that account for the size of the home.

9 tips for mastering KPIs for your cleaning business

#1: Implement a pricing strategy

Pay attention to detail and track relevant data to implement a pricing strategy effectively. Collect information on variables such as square footage, number of rooms, and other factors that influence pricing. Learn how to implement a full pricing system with this ZenMaid article.

#2: Present pricing to prospects

When presenting your pricing to prospects, consider different approaches based on your business model and target market. Options include providing an exact price per visit, offering a high-low pricing structure, or using hourly rates with a minimum charge. Choose the method that best aligns with your business and appeals to your potential customers.

#3: Simplify your invoicing

Invoicing can be done daily, weekly, or monthly, depending on the nature of the contract and your client base. Find a system that works best for your business and simplifies the invoicing process to ensure smooth financial transactions.

#4: Enhance your estimates

To enhance your estimates, consider incorporating videos and pictures. Embed videos in your estimates to explain the services, outline what’s included, and present your satisfaction guarantee. This personal touch can establish a stronger connection with the client and increase their confidence in your services. Utilize tools like the YouTube Creator app to create and upload videos easily.

#5: Maintain a well-organized sales pipeline

A well-organized sales pipeline is necessary for tracking and following up on estimates. Consider using third-party software like Logi to automate the follow-up process through email, text messages, and phone calls. This ensures that no estimate falls through the cracks and maximizes your chances of closing the sale.

#6: Track employee job costing

Monitor employee wages, labor burden, and associated costs to calculate the true cost of each job. Compare the budgeted hours with the actual hours worked and the revenue generated to assess the profitability of each job. Collect data on start and stop times using a mobile application or manual entry into your software. This data provides valuable insights into time spent on each job and helps you determine if you’re meeting your desired dollar-per-man-hour rate.

#7: Raise prices without emotion

Leverage the data collected and analyzed through tools like Logi to raise prices without emotions. Generate reports that highlight jobs where you’re not meeting your desired profitability targets. Instead of raising prices across the board, focus on the specific jobs or services that are falling short. You can maintain a fair pricing structure and maximize profitability by making data-driven adjustments.

#8: Automate your reports

Automate daily and weekly reports to keep track of key metrics such as budgeted time, clock time, job amount, and revenue per man-hour. These reports provide transparency and allow you to evaluate the performance of individual cleaners or teams. With this data at your disposal, you can make informed decisions and address any issues promptly.

#9: Conduct Regular Pricing Reviews

Conduct regular pricing reviews, typically twice a year, to adjust your prices based on your desired profitability targets. Raise prices on jobs that are not meeting your hourly goals while keeping prices steady for those that are already generating satisfactory revenue. This approach ensures you maintain good relationships with your best customers while improving profitability.

Wrapping up

Whew — that was a lot! We hope that by implementing these strategies, utilizing software tools, and focusing on data-driven decision-making, you can establish a profitable and predictable system for estimating and tracking profitability in your cleaning business. So, what are you waiting for? Start using these foundational strategies and tips today, and watch your profits soar!

Next steps

If you found this article helpful for your maid service, you may also like:

- Filthy Rich Cleaners Podcast E26: The Client Retention Strategy Your Competitors Don’t Want You to Know

- How to Set Up Your Cleaning Booking Forms with ZenMaid: The Complete Guide

- Filthy Rich Cleaners Podcast E25: How Kate Croukamp Built a 7-Figure Product Line in Her Cleaning Business

- How to Transition from Paper Scheduling to Software in Your Cleaning Business (Without Losing Clients or Your Mind)

- Filthy Rich Cleaners Podcast E24: Why I’m Cutting a $56k Service from My Cleaning Business

Watch Mike Callahan’s full presentation:

This talk first aired at the 2022 Maid Service Success Summit. The Maid Summit is an annual online event that brings together the most successful leaders in the cleaning industry, like Debbie Sardone, Angela Brown, Courtney Wisely, Amy Caris, Chris Schwab and more. Get free access to masterclasses and workshops to help you grow, scale, and automate your cleaning business to get more leads and profit. Make sure you’re on our email list to find out how to get free tickets to the next event.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.